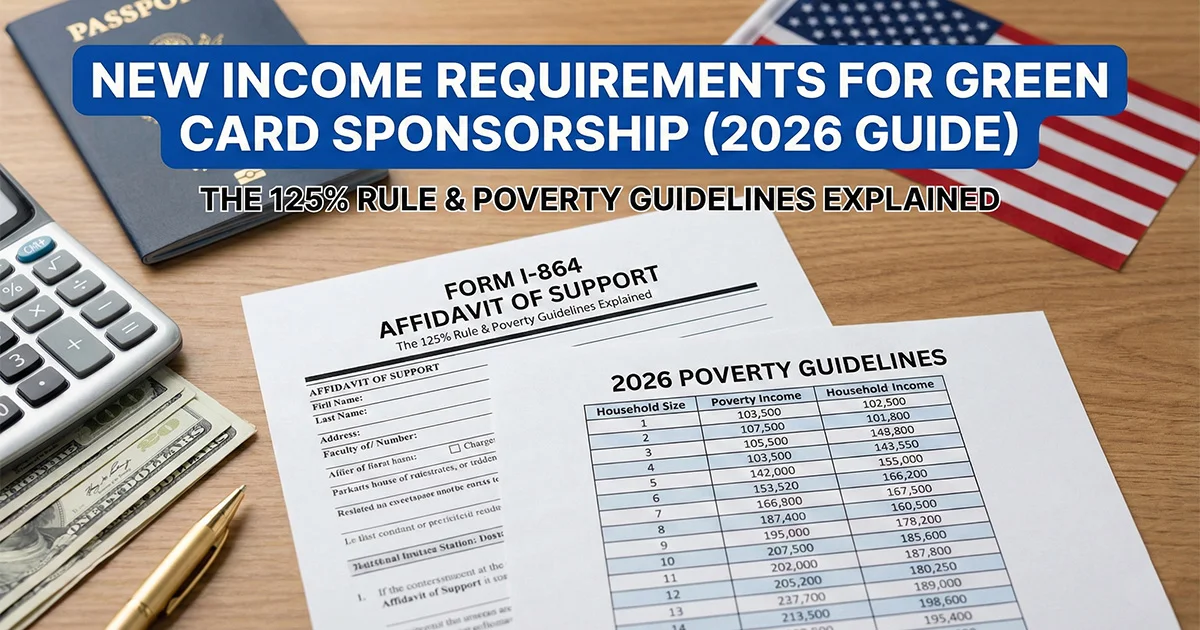

Can you sponsor your spouse in 2026? Check the new Poverty Guidelines, master the "125% Rule," and learn what to do if your income falls short.

It’s the number one fear for anyone sponsoring a family member: "Do I make enough money?"

You might have all your paperwork perfect. Your marriage is real. Your background check is clean. But if line 9 on your tax return is too low, the US government can—and will—deny your Green Card application.

On January 13, 2026, the Department of Health and Human Services (HHS) released the new 2026 Federal Poverty Guidelines. As expected, the numbers have gone up. This means the minimum income you need to prove on your Affidavit of Support (Form I-864) is higher than it was last year.

If you are filing for a spouse, parent, or child in 2026, here is the exact math you need to know to avoid a rejection.

The "125% Rule": The Magic Number

USCIS doesn't just want you to be "above the poverty line." They want a safety buffer.

For most sponsors, you must prove that your household income is at least 125% of the Federal Poverty Guidelines for your household size.

Who counts in your "Household Size"?

You can't just count yourself. You must include:

-

Yourself (The Sponsor).

-

The person you are sponsoring (The Beneficiary).

-

Any dependent children (under 21).

-

Anyone else claimed as a dependent on your taxes.

Example: You (Sponsor) + Your Wife (Beneficiary) + Your 1 child = Household Size of 3.

Official 2026 Income Requirements (48 Contiguous States)

Effective Jan 13, 2026.

The following table shows the minimum annual income you need to report on your taxes to pass the financial test.

Standard Sponsors (125% Rule)

Most people fall into this category.

| Household Size |

Minimum Annual Income (2026) |

| 2 (You + Spouse) |

$27,050 |

| 3 |

$34,150 |

| 4 |

$41,250 |

| 5 |

$48,350 |

| 6 |

$55,450 |

| 7 |

$62,550 |

| 8 |

$69,650 |

| Add for each extra person |

+$7,100 |

Active Duty Military (100% Rule)

Only applies if you are Active Duty Military sponsoring a spouse or child.

| Household Size |

Minimum Annual Income (Military) |

| 2 (You + Spouse) |

$21,640 |

| 3 |

$27,320 |

| 4 |

$33,000 |

| 5 |

$38,680 |

(Note: Residents of Alaska and Hawaii have higher thresholds. If you live there, add roughly $5,000 to these numbers.)

What Counts as "Income"?

Many clients panic because their salary is low, but they have other money. The good news is that USCIS looks at your "Total Income" (usually the Adjusted Gross Income on your 1040 tax return).

You CAN include:

-

Wages, salaries, and tips.

-

Retirement benefits.

-

Alimony and child support received.

-

Dividends and interest.

You CANNOT include:

-

SSI (Supplemental Security Income).

-

Welfare payments (TANF).

-

Unemployment benefits (sometimes accepted, but risky as it shows instability).

Comparison: 2025 vs. 2026 Requirements

To show you how the bar has been raised, look at the difference a year makes. If you prepared your forms in December 2025 but didn't file yet, your math is now wrong.

| Household Size |

2025 Minimum (Old) |

2026 Minimum (New) |

Increase |

| 2 |

~$25,550 |

$27,050 |

+$1,500 |

| 3 |

~$32,275 |

$34,150 |

+$1,875 |

| 4 |

~$39,000 |

$41,250 |

+$2,250 |

Data reflects the ~2.6% inflation adjustment applied in Jan 2026.

"I Don't Make Enough!" (3 Solutions)

If you looked at the table above and your heart sank, don't worry. You can still fix this.

1. Use Assets

If your income is short, you can use money in the bank, stocks, or property to fill the gap.

-

The Math: Your assets must equal 3 times the difference between your income and the requirement.

-

Example: You are short by $5,000. You need $15,000 in savings to fix it.

2. The "Joint Sponsor" (Most Common Fix)

This is the easiest solution. You can ask a friend or family member to be a "Joint Sponsor."

-

They must be a US Citizen or Green Card holder.

-

They must live in the US.

-

They must make enough money for their household plus your immigrant spouse.

3. Use the Immigrant's Income

Did you know your spouse's income might count?

[Internal Link: Joint Sponsor Checklist: What Documents Do They Need?]

Public Charge Rule: The 2026 Update

You may have heard scary stories about the "Public Charge" rule.

In 2026, the harsh "Trump-era" version of this rule is gone, but the concept remains. USCIS will look at the "Totality of Circumstances." This means they don't just look at the I-864 form; they look at the immigrant's age, health, and education.

However, the Affidavit of Support (I-864) remains the single most important document to overcome the Public Charge test. If you meet the 125% income threshold, you are generally safe.

Conclusion: Double-Check Before You Mail

The #1 reason for I-864 delays in 2026 is simple math errors. Using the 2025 numbers on a 2026 application will lead to a "Request for Evidence" (RFE), which can delay your Green Card by 3-6 months.

Your Next Step:

Pull out your 2025 Tax Return (or your most recent pay stubs). Compare line 9 (Total Income) to the table above. If you are even $100 short, find a Joint Sponsor now. Do not "hope" the officer won't notice. They will.

Need a Joint Sponsor Agreement drafted?

Our team can review your financial documents to ensure you pass the test on the first try.

References & Resources